Demand side - Fiscal Policy

Fiscal policy is government spending or taxing to affect aggregate demand.

Expansionary fiscal Policy: Is where the government increases spending and/or reduces taxation to increases aggregate demand

Contractionary fiscal policy: Is where the government decreases spending and/or increases taxation to decrease aggregate demand

Why does taxation affect aggregate demand?

How taxation affects demand can be seen in the following process:

- Households are taxed less

- Households have more to spend so consumption increases

- Consumption is part of GDP so Aggregate demand increases.

Types of fiscal policy

- Government spending

- Infrastructure

- Unemployment benefits

- Public services

- Healthcare

- Taxation

How fiscal policy is used to close recessionary or inflationary gaps

| Type of gap |

The problem |

The solution |

Diagram |

|

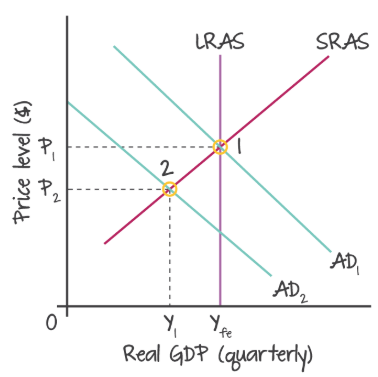

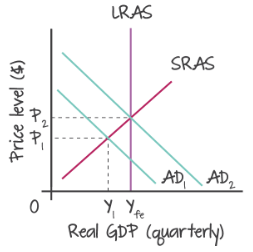

Recessionary (demand deficient)

|

In a recession, GDP falls and consequently demand is low, this results in the output being lower than the full employment level. |

Inorder to fix, this is the government using expansionary fiscal policy to increase aggregate demand |

|

|

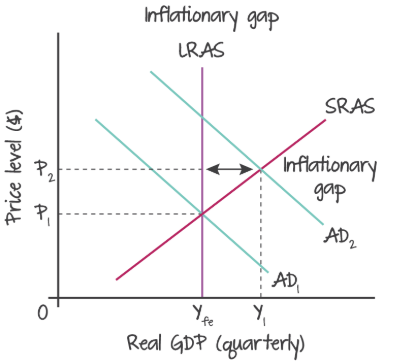

Inflationary (demand excess)

|

If the economy grows too fast demand-pull inflation may occur. In this case Aggregate demand, requires an output that is higher than full employment. |

To fix this, the government can use contractionary fiscal policy to lower aggregate demand back to normal levels. |

|

How fiscal policy is an automatic stabilizer

The government does not need to make a decision to use fiscal policy as they are always mimicking economic conditions experienced in the economy. Allowing the economy to auto stabilize.

| Economic growth |

Spending increases/decreases |

Cause |

| Recession (Low or negative economic growth) |

Increases |

- Unemployment benefits increase

- Income support payment increase

- Households pay less tax so they have more to spend

|

| Expansion (High or positive economic growth) |

Decreases |

- Unemployment benefits decrease

- Income support payment decrease

- Households are in higher tax brackets so they spend less

|

Evaluation of fiscal policy

Pros

- Ability to target sectors of economy, because governments choose where to spend money

- Direct impact on aggregate demand

- Promotes economic activity in recession

Cons

- Time lags

- Political constraints

- Crowding out (Using fiscal policy can backfire and cause AD to decrease)

- Inability to deal with supply side causes of instability

Demand side - Monetary Policy

Monetary policy is the use of interest rates and the money supply to influence the level of aggregate demand and economic activity in a country. Interest rates can be defined as the cost of borrowing.

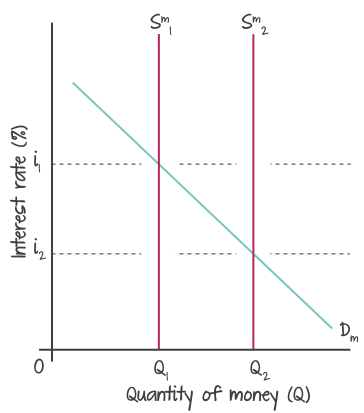

The relationship between quantity of money and Interest rates

This relationship is quite difficult to understand. But it helps to start by thinking of interest rates as the cost of borrowing money.

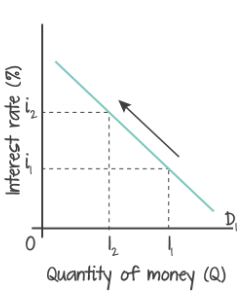

If money is scarce then it will cost more to borrow money because supply is low. Thus reducing the money in the system increases interest rates. Vice versa for when money is plentiful. An Investment market diagram is used:

As interest rates fall and quantity of money increases demand for money decreases. The supply of money is perfectly price inelastic because the central bank controls it.

Note: In the above diagram quantity of money is the independent variable, this is contrary to other diagrams where the variable on the y-axis the independent variable.

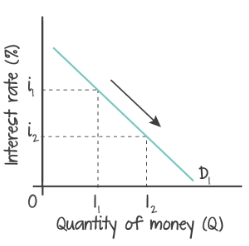

Role of monetary policy

Monetary policy is performed by the central bank, and it's only ability is to decrease or increase money supply. This in turn can affect more important things like interest rates or aggregate demand. So when demonstrating this two multiple diagrams are needed:

- Diagram 1 - Shows relationship between Quantity Money and Interest rates. An arrow must be drawn to show changing quantity of money.

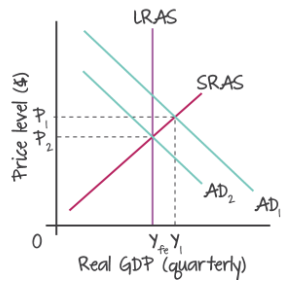

- Diagram 2 - Shows relationship between Price Level and Real GDP. This is standard demand and supply diagram. Showing that changes in investment and consumption changes Aggregate demand.

| Problem |

How does monetary policy solve this problem |

Diagrams required |

| Recessionary gap (demand deficient) |

A recessionary gap is caused by a demand deficiency so Aggregate demand must be increased. By increasing money in system, the central bank causes interest rates to go down. This causes people to consumer and invest more instead of saving, so aggregate demand goes up. |

|

| Inflationary gap (demand excess) |

An inflationary gap is caused by excess demand, so Aggregate demand must be reduced. This is done by decreasing the supply of money so that , interest rates goes up. This encourages people to save rather than consumer and invest so Aggregate demand goes down. |

|

Supply side Policies

These are policies to increase the potential output of the economy, or the supply, by improving the quality or quantity of factors of production. The government can either intervene with supply directly or intervene with the market which will indirectly affect supply.

Note: Theses policies often increase government spending so they affect both LRAS and AD.

Interventionist

Government intervention in the market process

| Sub-policy |

Aims |

Effects of policy |

Evaluation |

|

Human Capital

(Increase skills of the population in the country. measured by productivity)

|

- Education

- Health

- Training

- Migration

- Information

|

- Prevents unemployment

- Increases economic growth and productivity

- Increased standards of living

Example: Africa invests in education for the long run.

|

Disadvantages:

- Considerable time lag due to people being slow to learn

Advantages:

- Improves healthcare

- Effective in long run.

|

|

Industrial policies

(Affecting the industries and manufacturing.)

|

- Protect industries with subsidies

- Reduce taxes

|

- Balances structural changes

- Increases growth of companies

- Increases employment

|

Advantages:

- Some companies succeed e.g apple and this provides huge growth.

Disadvantages:

- Is biased towards favored companies. Can pick wrong companies.

- Can bring poverty in the short term (death of coal industry)

|

|

Infrastructure (public services)

(Building more physical and organisational structures and facilities)

|

- Build more transport facilities (e.g roads, bridges, railways)

- Buildings, and sanitation plants (e.g housing, sewage)

- Power supplies (e.g nuclear)

|

- Increases productivity (lower travel times)

- Increases living standards

- Brings tourism

- Increases production of energy and level of technology

- Increased employment

Example: China invests in infrastructure promoting large economic growth.

|

Advantages:

- Affects both demand side and supply side.

- Good for countries with large public sector

- Direct impact on economic growth

Disadvantages:

- Infrastructure takes long to build. E.g Nuclear power plant.

- In the short term there is massive debt, takes a long time to recover.

- Delays can be caused, which waste money and time.

- Sacrifice productivity in the short run.

|

Market based policies

This is government giving incentives. It is indirect intervention

| Sub-policy |

Aims |

Effects of policy |

Evaluation |

|

Increasing competitiveness

(Deregulating and privatizing the economy to increase competition between firms)

|

- Privatization: Removing monopolies to make sure no company has advantages over others so they are more competitive

- Deregulating industry: Makes industries able to compete with foreign countries ^.

|

- Makes companies increase their profits

- Promotes economic growth

- Reduces barriers to entry for small companies.

Example: England privatized the railway industry and it has not worked effectively

|

Advantages:

- Promotes opportunities

- Creates growth

- More R&D to outdo other firms

- Best skilled people employed

- Increases equity, reduces corruption

Disadvantages:

- Government cannot control prices. Privatized healthcare for example is often more expensive.

- Companies beat competition at any cost, often reducing social benefits.

|

|

Labor market reforms

(Make the market more flexible, by reducing intervention)

|

- reduce trade union power

- Reduce or eliminate minimum wages

- Reduction in unemployment benefits

- Reduce job security

|

Example: Germany succeeded to increase economic growth via labour reforms, known as the Hartz reforms in 2005.

|

Advantages:

Disadvantages:

|

|

Income tax cuts

(reduce taxes on consumer and corporation income)

|

- Lower corporation tax to encourage investment and increase employment

- Lower consumer tax so higher incentive to spend

- Lower capital gain tax (tax on things you get, like a will)

|

- Increases incentive to spend

- Increases incentive to invest

Example:

Britain 2018- tax cuts.

|

Advantages:

- Increased productivity

- Works well in higher status economies

- Increases employment

Disadvantages

- Hard to set taxes

- Can cause budget deficit

- Takes a long time to see effects.

- Increases income inequality, as they taxes tend to hit lower income classes more.

|

|

Research and development

(The government giving money to companies to help fuel their r&d)

|

- Give money to incentives development of new technology

|

- It increases production

- Changes consumers tastes so they spend more.

- Increases GDP

Example:

- Pharmaceutical companies in America/medicare

|

Disadvantages:

- Government may socialize the cost of devleoping the drugs but then privatize the profits from the product

-

|

View count: 22585